OPEC ministers are gathering in Vienna on Thursday to address the ongoing oil glut and figure out their next move.

Most analysts expect the cartel to extend production cuts for another six to nine months following recent statements from major oil players.

Earlier in May, both Saudi Arabia and Russia, who is not a member of OPEC but is seen as a critical part of any potential agreement, said they backed extending the production cuts until March 2018.

Moreover, Saudi energy minister Khalid al-Falih said in a joint news conference with his Iraqi counterpart, Jabar Ali al-Luaibi, on Monday that Iraq gave the “green light” to a proposal for extending cuts for nine months, according to Reuters. And that’s notable given that Iraq was one of the main obstacles to OPEC reaching an agreement on production cuts back in 2016.

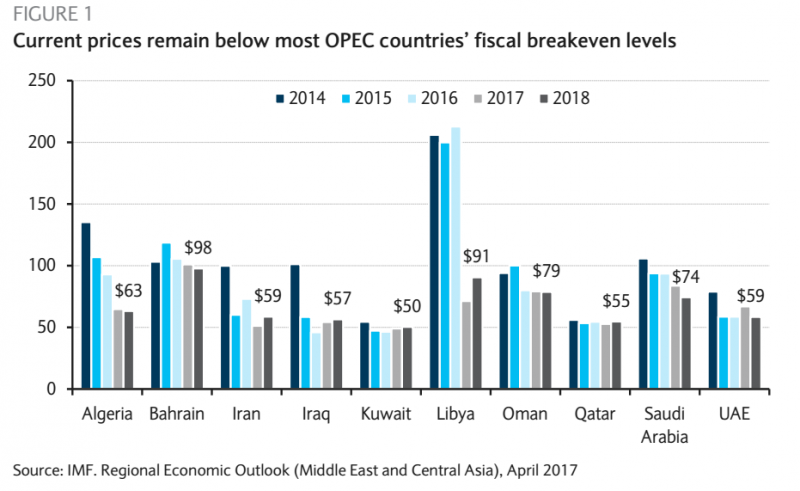

Major oil producers have faced financial stresses at home in the lower-for-longer price environment, which has likely been and will likely continue to be a key factor in petro-states embracing production cuts.

"In regards to an extension, while the technocratic oil ministers will likely cite elevated inventories and potentially the lack of long-term investment in conventional projects as reasons, we think that the domestic concerns of state leaders in their respective capitals will be the driving force, especially given the stakes if oil prices were to crater once again," Helima Croft, global head of commodity strategy at RBC Capital Markets, said in a note.

"Assuming an extension is achieved, an extended stay in the mid-fifties per barrel would likely be fine for the flusher GCC producers and key non-cartel producers like Russia - allowing them to execute on core priorities; however, for others it will more just keep them on much needed life support," she added.

OPEC and several non-OPEC producers agreed to cut output back in November, which marked the cartel's first cut since 2008 and reversed its two-year strategy of pumping as much oil as desired.

The cartel agreed to collectively cap output at 32.5 million barrels per day, a decrease of 1.2 million bpd, with the Saudis bearing the brunt of the cut. The decision reflects producers' desires to end the global oil supply glut, which has kept prices depressed for over two years, which, in turn, hampered the petro-states' economic growth.

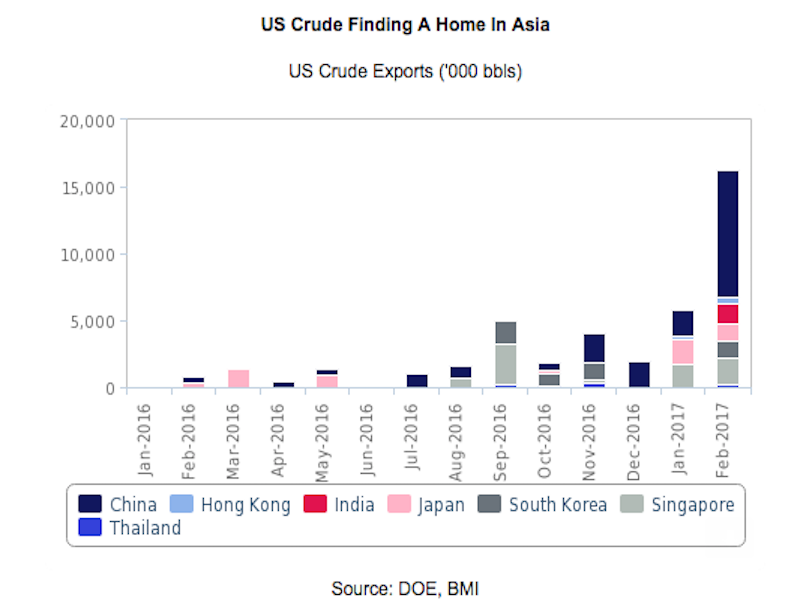

When it comes to output cuts, the elephant in the room is, of course, US crude production. Weekly exports have regularly poked through 1 million barrels per day this year, and US oil has likely been a factor in oil prices not rising significantly amid the cuts.

"We have noted before that the growth in US shale production will put a cap on oil prices, at least barring a major geopolitical blowout that takes significant quantities of production elsewhere offline," Croft's team said.

However, it's not just about the prices. BMI Research analysts said in a note that a cut extension will mean supplies from the Middle East will remain "constrained," which then, in turn, further opens up strategic market opportunities for US crude.

China has already upped its consumption of US crude; it was even the largest buyer of US crude in February, according to data cited by BMI Research. And that's a notable detail given that China has been one of the big oil battlegrounds in recent years, with producers like Saudi Arabia and Russia clawing at its coveted market share.

"This is part of a broader strategic shift for the world's largest crude importer to diversify supplies away from its heavy dependence on Middle Eastern grades," the BMI Research analysts explained, referring to China.

"While supplies from the US amounted to less than 1% of the China's total imports in the first two months of 2017, it is likely that this volume will grow over the coming years as US exports rise, cementing its position as a key outlet for US grades."

Looking to Thursday, although it increasingly seems likely that the cartel and other producers will opt to extend the cuts, the exact countries participating and their exact quota levels remain unclear. Moreover, some analysts have noted that markets could soon start looking for signs of an "exit strategy."

"For now, several factors are keeping OPEC and non-OPEC countries in market management mode. The policy has given OPEC countries roughly at 10% bump in revenues compared to a scenario where output remained high at 4Q16 levels," Barclays' Michael Cohen and Warren Russell wrote in a report to clients.

"But the longer that OPEC engages in such market management, the more concerned market participants will become about the eventual end of the agreement," they continued. "Thus, we believe OPEC needs to articulate an exit strategy."

WTI Crude oil, the US benchmark, was down by 0.3% at $51.30 per barrel, while Brent crude oil, the international benchmark, was down by 0.2% at $53.91 per barrel around 2:43 p.m. ET.